Our teaching

The team of Prof Dr Dr h.c. Dr. h.c. Caren Sureth-Sloane offers the modules listed below. Detailed information is available by clicking on the respective module. Click here for the complete module handbook of the Faculty of Business Administration and Economics.

Further information and materials on the modules we offer can be found in the module catalogue and, after logging in with your university account, on the PAUL and PANDA platforms.

Bachelor

| Module name | Semester | ECTS | Language | Lecturer | Organisation |

| M.184.2219 TX4 Transfer Taxes | summer semester | 5 | DEU | Prof. Dr. Dr. h.c. Dr. h.c. Caren Sureth-Sloane | Maria Höne |

| M.184.2218 TX3 Case Studies in Corporate Taxation | summer semester | 5 | DEU | Prof. Dr Jens Müller | Daniel Dyck |

| M.184.1202 Taxation, Accounting & Finance | summer semester | 10 | DEU | Prof. Dr. Dr. h.c. Dr. h.c. Caren Sureth-Sloane | Yuri Piper |

| M.184.2216 TX1 Corporate Taxation | winter semester | 5 | DEU | Prof. Dr Jens Müller | Yuri Piper |

| Bachelor thesis Taxation, Accounting & Finance | winter semester / summer semester | 10 | DEU | Prof. Dr. Dr. h.c. Dr. h.c. Caren Sureth-Sloane | Stefanie Jack |

Master

| Module name | Semester | ECTS | Language | Lecturer | Organisation |

| M.184.4222 International Taxation | summer semester | 10 | DEU | Prof. Dr. Dr. h.c. Dr. h.c. Caren Sureth-Sloane | Kim Alina Schulz |

| M.184.4225 Reorganisation Tax Law | winter semester | 5 | DEU | Prof. Dr. Oliver Middendorf / Dr. Anja Rickermann | Kim Alina Schulz |

| M.184.4224 Choice of legal form & tax planning | winter semester | 10 | DEU | Prof. Dr. Dr. h.c. Dr. h.c. Caren Sureth-Sloane | Daniel Dyck |

| M.184.4223 Current research issues in business taxation | summer semester | 5 | DEU | Dr Henning Giese | Kim Alina Schulz |

| Master's thesis Taxation, Accounting and Finance | winter semester / summer semester | 20/30 | DEU | Prof. Dr. Dr. h.c. Dr. h.c. Caren Sureth-Sloane | Stefanie Jack |

We take part in the centralised allocation procedure for final theses. The procedure distributes the students who wish to write a thesis fairly among the professorships. All information on the centralised allocation procedure.

Information on writing your thesis at our professorships can be found here.

You can find information on the requirements for theses from our department in the following information sheets:

Exchange programme supervised by us

Students of economics can apply for a study abroad programme. We run an exchange programme with the Karl-Franzens-University Graz and University of Applied Sciences Utrecht.

If we have aroused your interest, you should find out about the next steps (application deadlines, forms, etc.) as soon as possible. Please note the current information on our homepage and the notices on the professorship notice board on level Q5.

Tax advice | Auditing | Consulting

If you discover an interest in tax planning and tax structuring during your studies, you will open up interesting career and life paths for your future. In combination with specialist expertise in accounting, company law, international law, labour law and/or business organisation, you will be ideally equipped for a career in tax consultancy, auditing or business consultancy (consulting).

Your education at the Faculty of Business Administration and Economics at Paderborn University is designed to offer you a broad range of methodological knowledge in addition to specialist aspects, which you can use profitably in your professional practice.

You should take the study recommendations for the various Paderborn degree programmes developed in the following overview as a suggestion for your individual study planning. However, a good knowledge of corporate taxation and internal and external accounting is essential for tax and business consultancy professions.

Recent publications

2026

Liquidity Effects of a Wealth Tax on Residential Rental Real Estate

Maiterth, R., Piper, Y., & Sureth-Sloane, C. (2026). Liquidity Effects of a Wealth Tax on Residential Rental Real Estate. https://doi.org/10.2139/ssrn.6147767

Determinants of Tax Complexity: Evidence from a Developing Country

Schipp, A., Siahaan, F., & Sureth-Sloane, C. (2026). Determinants of Tax Complexity: Evidence from a Developing Country. Intertax, 54(2), 102–122. http://dx.doi.org/10.2139/ssrn.4924632

Banks' tax disclosure, financial secrecy, and tax haven heterogeneity

Eberhartinger, E., Speitmann, R., & Sureth-Sloane, C. (n.d.). Banks’ tax disclosure, financial secrecy, and tax haven heterogeneity. Journal of International Accounting, Auditing and Taxation (JIAAT).

2025

Abschreibungen als Mittel der Investitionsförderung in Deutschland - Möglichkeiten, Grenzen und Perspektiven evidenzbasierter Analysen

Dyck, D., Hechtner, F., Maiterth, R., & Sureth-Sloane, C. (2025). Abschreibungen als Mittel der Investitionsförderung in Deutschland - Möglichkeiten, Grenzen und Perspektiven evidenzbasierter Analysen. Steuer Und Wirtschaft, Sonderheft NeSt, 102(3), 26–44.

Abschreibungen als Mittel der Investitionsförderung in Deutschland – Möglichkeiten, Grenzen und Perspektiven evidenzbasierter Analysen

Dyck, D., Hechtner, F., Maiterth, R., & Sureth-Sloane, C. (2025). Abschreibungen als Mittel der Investitionsförderung in Deutschland – Möglichkeiten, Grenzen und Perspektiven evidenzbasierter Analysen. http://dx.doi.org/10.2139/ssrn.5337276

How Much to Pay for Tax Certainty? The Role of Advance Tax Rulings for Risky Investment under Loss Offset and Tax Uncertainty

Chen, A., Hieber, P., & Sureth-Sloane, C. (2025). How Much to Pay for Tax Certainty? The Role of Advance Tax Rulings for Risky Investment under Loss Offset and Tax Uncertainty. International Tax and Public Finance. https://doi.org/10.1007/s10797-025-09930-8

How Much to Pay for Tax Certainty? The Role of Advance Tax Rulings for Risky Investment under Loss Offset and Tax Uncertainty

Chen, A., Hieber, P., & Sureth-Sloane, C. (2025). How Much to Pay for Tax Certainty? The Role of Advance Tax Rulings for Risky Investment under Loss Offset and Tax Uncertainty. https://doi.org/10.1007/s10797-025-09930-8

Who Bears the Costs of the UK Soft Drink Tax? An Empirical Study of Medium-Term Effects

Wiredu, L. D. A. (2025). Who Bears the Costs of the UK Soft Drink Tax? An Empirical Study of Medium-Term Effects. Junior Management Science, 10(4), 985–1008. https://doi.org/10.582/jums/v10i4pp985-1008

Steuern und Steuergerechtigkeit – Ein Gespräch

Schönhärl, K., & Sureth-Sloane, C. (2025). Steuern und Steuergerechtigkeit – Ein Gespräch. Ethik und Gesellschaft, 19 (2): Die andere Seite der sozialen Gerechtigkeit: Eine gerechtere Finanzierung steigender öffentlicher Ausgaben, 1–31. https://doi.org/10.18156/eug-2-2025-art-2.

The Consequences of Abandoning the Quarterly Reporting Mandate in the Prime Market Segment

Bornemann, T., Moosmann, A.-L., & Novotny-Farkas, Z. (2025). The Consequences of Abandoning the Quarterly Reporting Mandate in the Prime Market Segment. European Accounting Review, 34(1), 89–122. https://doi.org/10.1080/09638180.2023.2239298

Show all publications

Research & Network

Academic career of Prof. Dr. Dr. h.c. Dr. h.c. Caren Sureth-Sloane

Research assistants & doctoral students

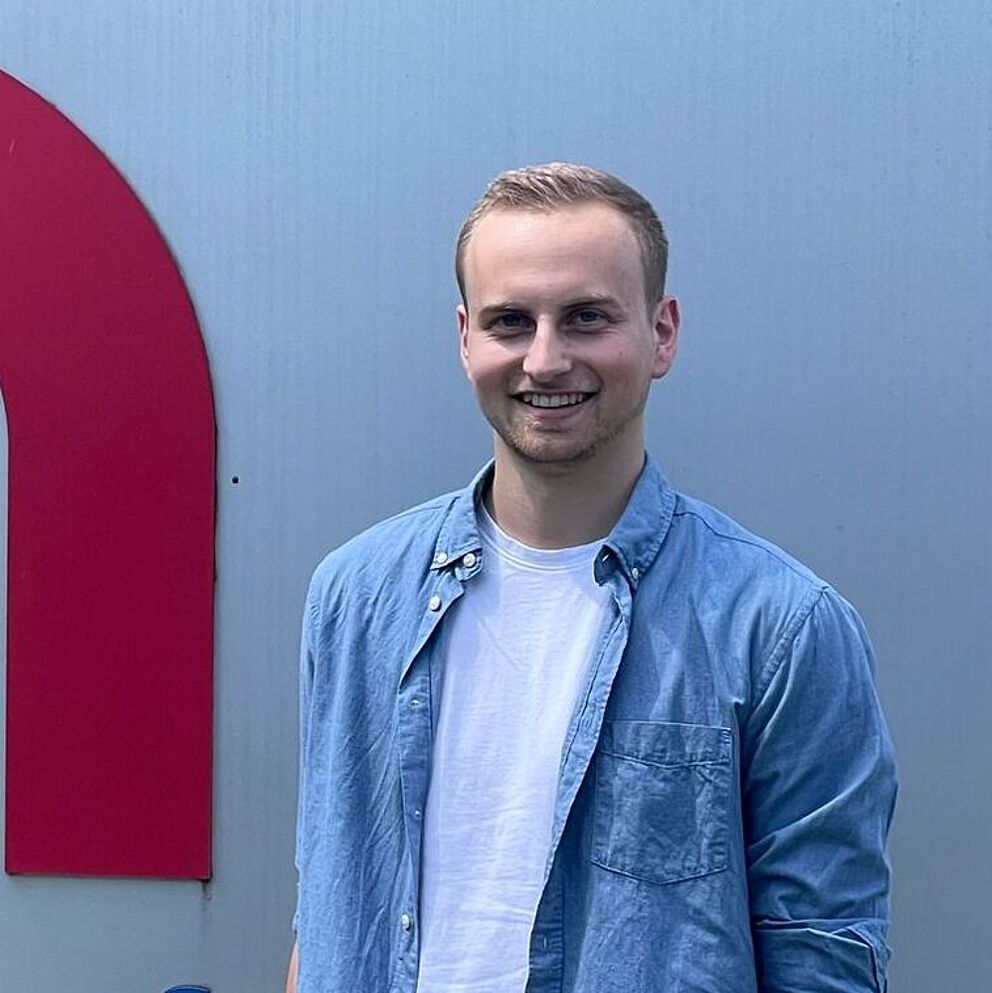

Research Assistant TRR 266 Accounting for Transparency (B01 - Investment Effects of Multidimensional Tax Regulation). Research Focus: Tax Disputes

Office: Q5.140

Phone: +49 5251 60-5365

E-mail: daniel.dyck@uni-paderborn.de

Office hours:

nach Vereinbarung

Research Assistant TRR 266 Accounting for Transparency (A05 - Accounting for Tax Complexity). Research Focus: Tax Complexity

Office: Q5.143

Phone: +49 5251 60-2926

E-mail: henning.giese@uni-paderborn.de

Office hours:

by appointment

Office: Q5.337

Phone: +49 5251 60-1786

E-mail: maria.hoene@uni-paderborn.de

Office hours:

nach Vereinbarung

Manager - Managing Director SFB/TRR 266 Accounting for Transparency

Office: Q5.340

Phone: +49 5251 60-1785

E-mail: elmar.janssen@uni-paderborn.de

Web: Homepage

Office hours:

By appointment.

PhD Student & Research Assistant TRR 266 Accounting for Transparency (B08 - Tax Burden Transparency). Research Focus: Tax Misperception

Office: Q5.334

Phone: +49 5251 60-1789

E-mail: yuri.piper@uni-paderborn.de

Office hours:

by appointment

PhD Student & Research Assistant TRR 266 Accounting for Transparency (A05 - Accounting for Tax Complexity; B01 - Investment Effects of…

Office: Q5.334

Phone: +49 5251 60-1788

E-mail: kim.alina.schulz@uni-paderborn.de

Office: Q5.140

Phone: +49 5251 60-5366

E-mail: gereon.seifert@uni-paderborn.de

Office hours:

nach Vereinbarung

Office: Q5.337

Phone: +49 5251 60-1787

E-mail: laura.wiredu@uni-paderborn.de

Office hours:

nach Vereinbarung

Team overview & former doctoral students and research assistants

Science Communication

Head -

Office: Q5.340

Phone: +49 5251 60-1784

E-mail: julia.goerdes@uni-paderborn.de

Office hours:

Montag bis Freitag

Studen assistants

Office: Q5.343

Phone: +49 5251 60-1783

E-mail: finnrb@campus.uni-paderborn.de

Office: Q5.343

Phone: +49 5251 60-1783

E-mail: dinithi@campus.uni-paderborn.de

Former student assistants

Team assistant

Secretary -

Office: Q5.346

Phone: +49 5251 60-1782

E-mail: stefanie.jack@upb.de

Office hours:

Mo. - Fr., 08:00 - 14:00 UhrJobs and events

| Company | Application deadline | Offer |

|---|---|---|

| KPMG AG Wirtschaftsprüfungsgesellschaft | 06.06.2024 | KPMG Backstage Bielefeld |

| Ernst & Young Global Limited | open-ended | Backstage Day in tax consulting |

| PricewaterhouseCoopers GmbH | unlimited | Career events at your university |