Vom Hörsaal direkt in die steuerpolitische Praxis

Gemeinsam mit den Studierenden von Prof. Dr. Jens Müller und Prof. Dr. Dr. h.c. Dr. h.c. Caren Sureth-Sloane haben wir bei unserem Ausflug nach Berlin praxisnahe Eindrücke in die deutsche Finanz- und Steuerpolitik gewonnen.

Der Morgen startete mit dem Besuch einer Sitzung des Finanzausschusses im Deutschen Bundestag, bei der wir miterleben konnten, wie Finanzpolitik und Steuergesetze aktiv diskutiert und gestaltet werden.

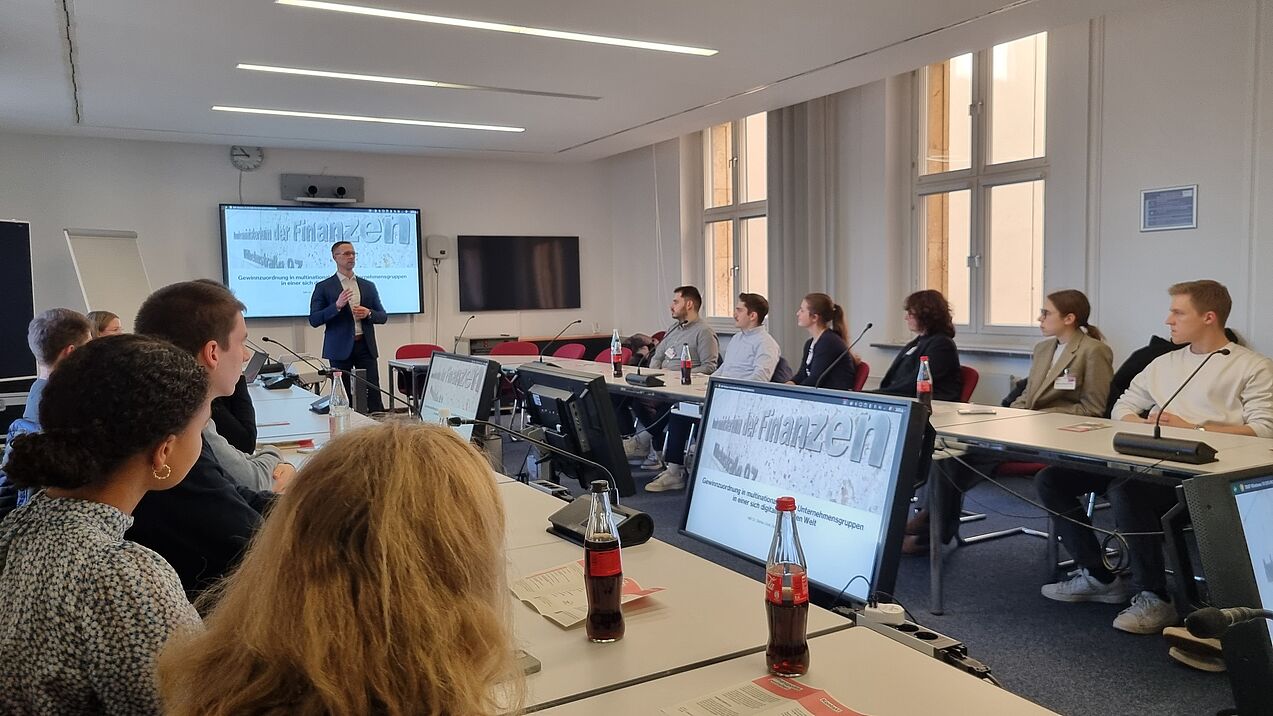

Unser zweiter Stopp führte uns in das Bundesministerium der Finanzen (BMF), wo wir einen lehrreichen Überblick über die Aufgaben des BMF erhielten. Wir diskutierten über Gerechtigkeitsempfindungen bei der Besteuerung multinational tätiger Unternehmen und bekamen so Einblicke in die Herausforderungen bei der Gestaltung unserer Steuergesetze. Ein weiteres Highlight war die exklusive Tour durch das geschichtsträchtige Gebäude des BMF.

Zum Abschluss durften wir den Bundesverband der Deutschen Industrie (BDI) besuchen, um in einem aktiven Austausch mehr über die Arbeit und die Vertretung verschiedener Interessengruppen im Hinblick auf Steuern kennenzulernen.

Herzlichen Dank an Dr. Stefan Greil für die tollen Einblicke ins BMF. Ein weiterer Dank gilt Dr. Nadja Fochmann und Benjamin Koller für den regen Austausch mit unseren Studierenden im BDI.