TAF Research Seminar

On May 3, 2022, Gregor Weiß (Leipzig University) will present the paper "Characteristic Portfolios, Conditional Quantile Curves, and the Cross-Section of Option Returns" at the TAF Research Seminar. The paper is joint work with Felix Irresberger (Durham University, UK) and Simon Fritzsch (Leipzig University).

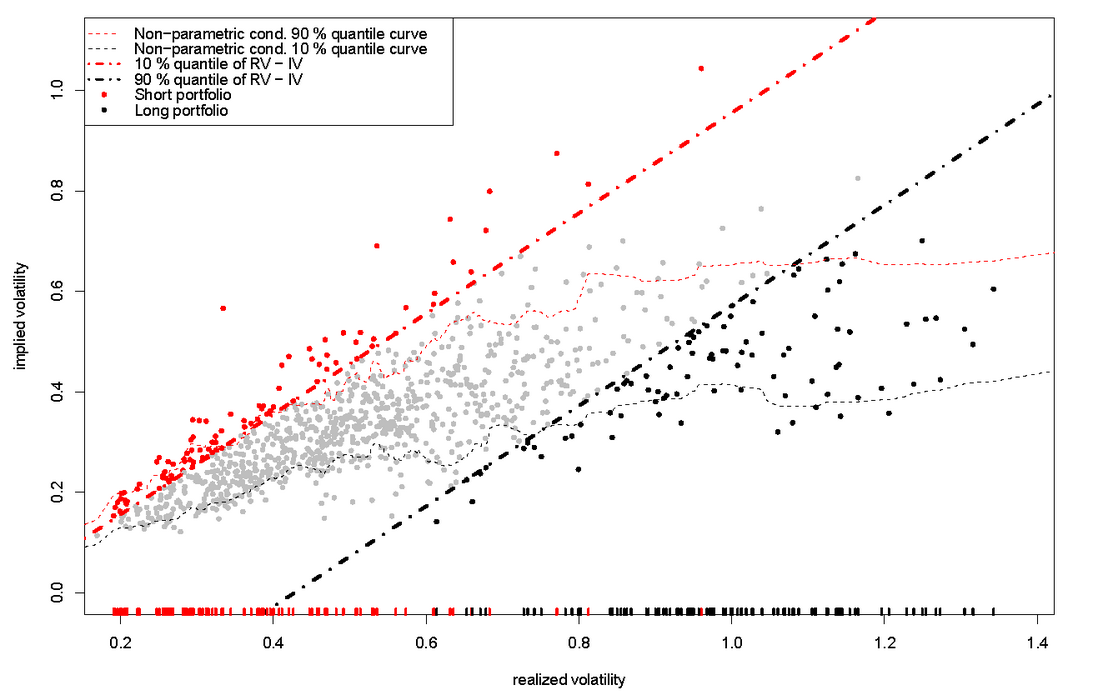

The paper proposes to use non-parametric machine learning methods to estimate quantile curves in asset pricing. The advantage over standard methods such as portfolio sorts and cross-sectional regressions is that the formation of portfolios based on conditional quantile curves leads to characteristic portfolios that should reflect only the priced-in risk associated with the characteristic. The authors apply the procedure to the valuation of volatility risk in the cross-section of option returns and show that the Sharpe ratios of the resulting characteristic portfolios are up to 30% higher than those of comparable strategies.

Gregor Weiß received his Doctorate from the Ruhr University in Bochum. Subsequently, he worked as a Juniorprofessor at TU Dortmund University, before he took over the Chair of Business Administration / Sustainable Financial Services, esp. Banks at Leipzig University. He is also a visiting professor at Keio University in Tokyo (Japan). His research covers banking regulation and supervision, systemic risks in banking and insurance, financial innovation and digitalization in banking, and the use of modern techniques in risk management. His research has been published in the Review of Finance, Journal of Financial Intermediation, Journal of Banking & Finance, Journal of Risk and Insurance, and other leading journals.